Roman architecture was never only about engineering marvels—it was about serving the people.

- Aqueducts carried water into cities, powering daily life and public health.

- Forums became centers of democracy, enabling civic discourse.

- Public baths weren’t just about hygiene—they built community and connection.

Every structure was designed for a public purpose, empowering citizens and improving lives at scale.

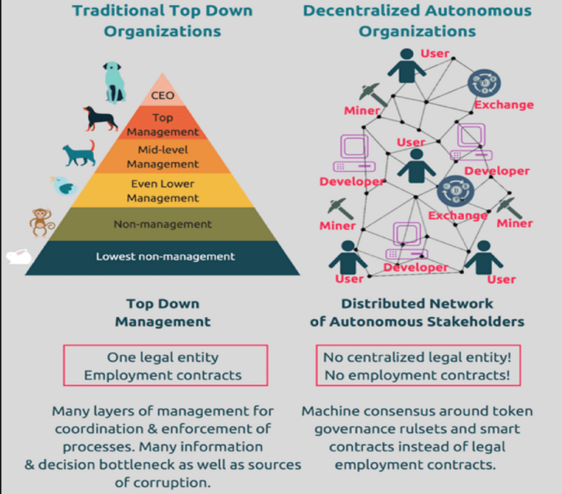

AWS Services as Digital Public Infrastructure

AWS generative AI reflects this civic philosophy by democratizing access to cutting-edge models through cloud-native services. Instead of aqueducts and forums, we have APIs and managed services that distribute intelligence and capability:

- Amazon Bedrock

Provides serverless APIs to foundation models from providers like Anthropic, Meta, Cohere, and Mistral. Developers don’t need to manage infrastructure or train massive models—they can instantly consume them, just as Roman citizens accessed aqueduct water without needing to understand the engineering behind it. - Amazon SageMaker

Functions as the forum for builders and scientists. It offers a collaborative environment to build, train, fine-tune, and deploy custom generative AI models. Features like SageMaker Studio, JumpStart, and Model Registryensure that teams can innovate together with governance and efficiency. - Inferentia & Trainium Chips

These custom AWS chips are the concrete and aqueduct channels of today’s AI infrastructure. They provide high-performance, cost-optimized inference and training for generative models. By lowering compute costs, they make AI more accessible to startups and enterprises alike. - Amazon API Gateway & Lambda

Think of these as the digital conduits—akin to aqueduct pipes—that distribute AI capabilities to millions of users via apps, websites, and services, without requiring heavy infrastructure investments. - Amazon OpenSearch & Kendra

These services act like the forums of old—organizing and retrieving information so that people can ask questions and access knowledge easily. When paired with generative AI, they enable natural language search and contextual insights across massive data sets.

The Legacy Parallel

Roman concrete still holds strong after 2,000 years, a testament to their vision for longevity. Similarly, AWS’s cloud-native AI stack—built on principles of scalability, modularity, and sustainability—ensures innovation can endure and adapt for generations of technology.

Both remind us that the greatest architectures, whether carved in stone or provisioned in code, are those that serve people broadly and meaningfully.

This concludes the three part comparison of Roman architecture to AWS generative AI services.

![Crypto Statistics [year]: Global Ownership & Adoption Data 1 Global Cryptocurrency](https://thesmallbusinessblog.net/wp-content/uploads/2022/03/Global-Cryptocurrency.png) Courtesy: Small business blog

Courtesy: Small business blog![Crypto Statistics [year]: Global Ownership & Adoption Data 2 cryptocurrency](https://thesmallbusinessblog.net/wp-content/uploads/2022/03/cryptocurrency.png)

:strip_icc()/2008-financial-crisis-3305679-final-JS-03a006d464d7465aaf331145a1252beb.png)