“If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.” – Satoshi Nakamoto

We continue our journey into Decentralized Finance (DeFi) with the discussion around Cryptocurrencies and Blockchains. In the past several posts, I have provided background on the various aspects of the Web 3.0 ecosystem.

- Part 1: Web 3.0, What is it and Why it matters

- Part 2: Web 3.0 applications – Community managed applications

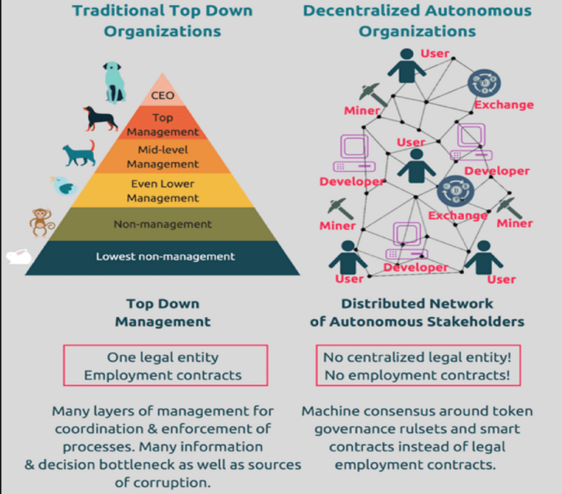

- Part 3: Decentralized Autonomous Organizations (DAOs) – Community owned governance

- Decentralized Finance (DeFi) – Community Finance

- Part 4a: Intro to DeFi

- Part 4b: Cryptocurrencies

- Stable-coins and Central Bank Digital Currencies – Fiat collateralized and Government issue digital coins

- Creator Economy & Non-Fungible Tokens (NFTs) – Community creations

- Blockchain based games – Community built, created and owned Games

The timing of this post comes in the heels of the recent development in Terra Luna and UST which in itself is terrible but not a death knell for cryptocurrency. I approach the cryptocurrency subject as a technological innovation rather than a speculative asset class. If you recall the dot com boom, there was innovation and fraud that permeated the system and eventually some companies came out of it successfully. We can see similar situation here. Let’s get back to our learning on the Web 3.0 and focus on cryptocurrencies.

What is Cryptocurrency?

According to Wikipedia, Cryptocurrency is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank to uphold and maintain it.

There are three key characteristics that makes it difficult to dismiss the importance of cryptos.

-

-

- Trustless – Since the system is peer-to-peer, no trust between the sender and recipient is required. In addition, the incentives for the miners is adequate enough to not defraud the users but to add it to the blockchain resulting in the integrity of the environment.

- Immutable – Transaction cannot be reverted since it is permanently recorded in the ledger and transmitted across all nodes.

- Decentralized – No central agency that controls the creation of the new coins or transfer of the coins from one entity to another. Granted exchanges facilitate those transfers but there are multiple exchanges and a user can go to any exchange to get the task completed without having rely on only one.

-

Let’s take an example of sending money from one country to another country through wire. The processing has the following steps and it will take at least five business days (may change depending not the recipient country) for the recipient to get the payment.

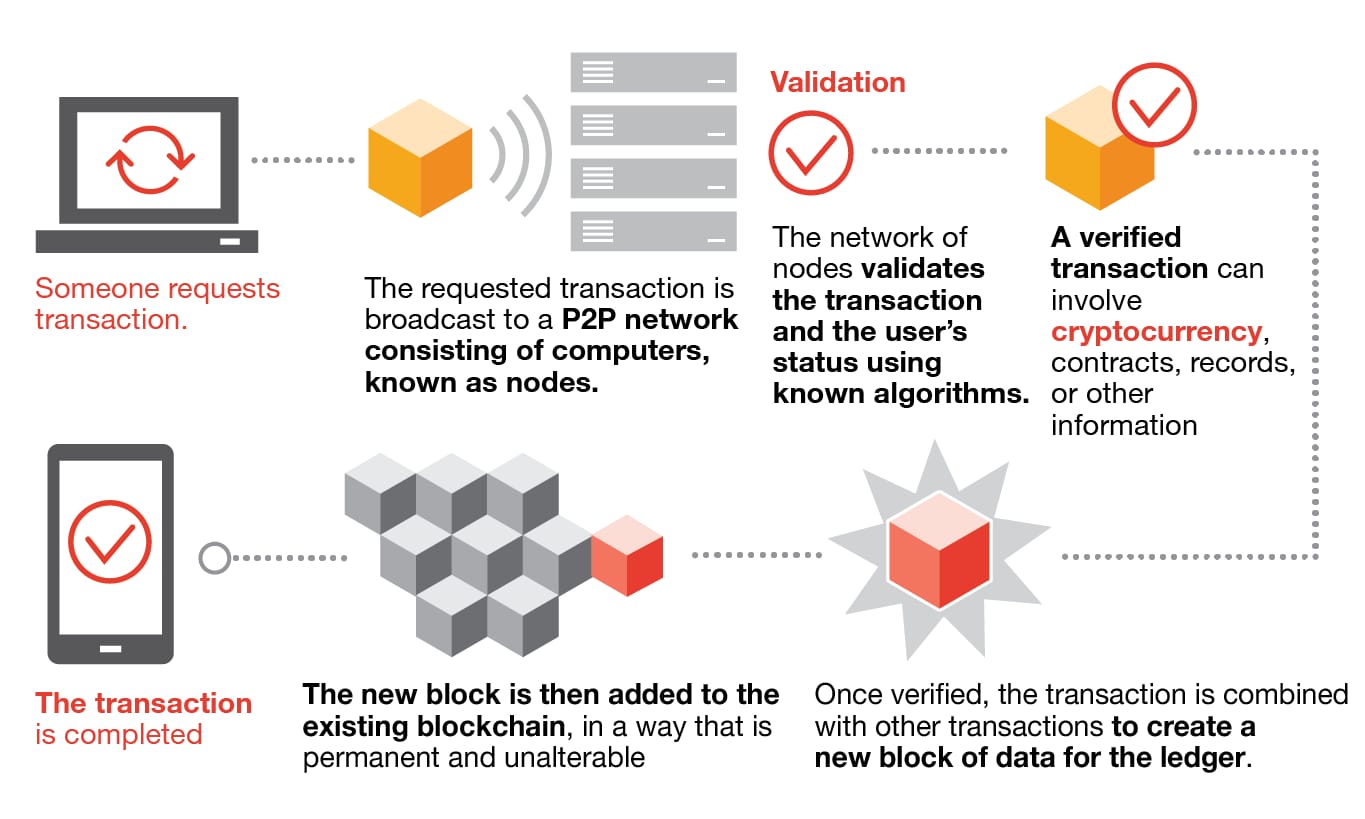

The central banks/correspondent banks act as intermediaries to oversee the payments to or from the senders/receiver. Now let’s review how Cryptocurrency works.

In this peer to peer system, because there is no central agency, the entities easily transfer their resources (currencies) to make an entry or exit on the positions. As a result, the payments are near real time. Bitcoin transactions can take place within 10 to 15 minutes, Ethereum within five minutes and so on. The quickness of the transfers is unbelievable and liquidity is instantaneous.

Another benefit would be to prevent corrupt and oppressive governments intervening and siphoning off funds from the citizens. By using cryptocurrencies, the citizens can protect their wealth since it will be stored in their wallets with the private keys that is not accessible by the governments. They can migrate to other countries and liquidate the cryptocurrencies without any issue.

Requires just internet and anyone can begin transacting with the cryptocurrencies. Today there are over 300+ million users and this is huge considering there were zero users a decade ago.

![Crypto Statistics [year]: Global Ownership & Adoption Data 1 Global Cryptocurrency](https://thesmallbusinessblog.net/wp-content/uploads/2022/03/Global-Cryptocurrency.png) Courtesy: Small business blog

Courtesy: Small business blog

The adoption rates are comparable to the internet growth

![Crypto Statistics [year]: Global Ownership & Adoption Data 2 cryptocurrency](https://thesmallbusinessblog.net/wp-content/uploads/2022/03/cryptocurrency.png)

Courtesy: Small business blog

Numerous brands and companies are accepting the crypto payments. Here is a list that may not be exhaustive for Bitcoin payments.

Courtesy: Spendmenot

Why do they matter?

-

-

- Cryptocurrencies allow low cost, nearly instantaneous, borderless, peer-to-peer transfers of actual value

- Low barrier to entry and not subject to business hours in mainstream financial institutions

- Payment blockchains open up access to financial services to unbanked/underserved people worldwide

- Mobile wallets make it cheaper for immigrants to transfer money to their homeland

- Can provide safer store of value in countries with hyperinflation

-

The market cap as we speak is hitting $1.3 Trillion which is no joke and of course, the volatility is not for faint of heart. It went up to $3 Trillion last November before coming down to the current levels. Comparing this withUS Stock Exchange that has the market cap of around $53 Trillion, we are at the early stages of a financial asset.

In our next installment we will review other aspects of DeFi like lending, farming etc., Meanwhile I will be taking few weeks off this summer and resume the posts in July. Happy Summer everyone!

:strip_icc()/2008-financial-crisis-3305679-final-JS-03a006d464d7465aaf331145a1252beb.png)