Stablecoins are like money market funds, they’re like bank deposits. But they’re to some extent outside the regulatory perimeter, and it’s appropriate that they be regulated

– Jerome Powell

In the past several posts, I have provided background on the various aspects of the Web 3.0 ecosystem. We will focus on Stable Coins and Central Bank Digital Currencies (CBDCs) in this post.

- Part 1: Web 3.0, What is it and Why it matters

- Part 2: Web 3.0 applications – Community managed applications

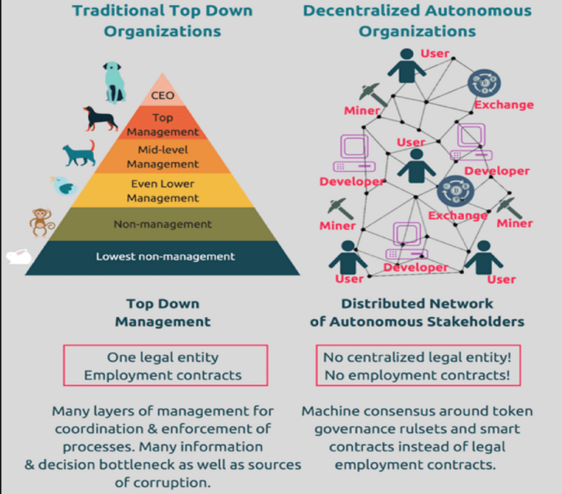

- Part 3: Decentralized Autonomous Organizations (DAOs) – Community owned governance

- Part 4: Decentralized Finance (DeFi) – Community Finance

- Part 5: Stable-coins and Central Bank Digital Currencies (CBDCs) – Fiat collateralized and Government issue digital coins

- Part 6: Creator Economy & Non-Fungible Tokens (NFTs) – Community creations

- Part 7: Blockchain based games – Community built, created and owned Games

Stable Coins

Stable coins are privately-issued cryptocurrency that maintains stable value relative to another asset for e.g., USD, Euro, Fiat-collateralized stable coins. These types of cryptocurrencies were created to provide an alternative to cryptocurrencies.

*Source: 101blockchains.com

Stable coins aims to mimic traditional currencies and is typically a cryptocurrency that is collateralized by the value of an underlying asset. The lure of these coins are that these are not subject to the extreme price volatility that many other cryptocurrencies encounter. For e.g., last November one Bitcoin was worth $66k and the same one Bitcoin is worth $24k today (8/13/2022). However, if you compare one Tether ( one of the stablecoins) was worth $1.03 last November and it is at $1 today (8/13/2022).

From a business owner perspective, if someone buys a product with a cryptocurrency like Bitcoin, they need to convert it to a Fiat currency to keep the value stable. Some exchanges don’t allow this conversion. Stablecoins serve this purpose to ensure the values are maintained in spite of the fluctuations in cryptocurrencies.

There are four types of Stable-coins:

-

- Fiat-Collateralized

- Most of the stablecoins are backed by fiat currency. What this means is that, for every single stablecoin, there is a corresponding fiat currency held in a bank account. If an investor wants to convert their stablecoin to a fiat currency, the exchange will withdraw the fiat currency held in the bank and pay the investor the fiat currency. Then burn the equivalent stablecoin to maintain the balance. This simplicity has great advantages as everyone can understand the cryptocurrencies easily that would allow for more adoption. Most common are Tether, USDC, Gemini Dollar (GUSD) and Pax Dollar(USDP).

- Fiat-Collateralized

-

- Commodity-Collateralized

- These are collateralized with other kinds of interchangeable assets. The most common commodity is Gold. There are other stablecoins backed by oil, real estate and various precious metals. The owners are exposed to the value of real-world asset. They have potential to appreciate or depreciate over time. They are marketed as a way to allow smaller investors to enter some asset classes like Real Estate. Common stablecoins in this category are Digix Gold (DGX) and SwissRealCoin(SRC) backed by Swiss real estate.

- Commodity-Collateralized

-

- Crypto-Collateralized

- These stablecoins are backed by other cryptocurrencies. They are more decentralized since the collateral lies within the same blockchain. To reduce volatility risks, they are over-collateralized to absorb market fluctuations. For e.g., if we need to buy $100 worth of stablecoins, it has be collateralized with $200 worth of cryptocurrencies. If the underlying cryptocurrency loses value, to some extent the owners can be compensated but if it is too low, the stablecoin is liquidated. They are very complex and therefore didn’t take off like fiat-collateralized stablecoins. One example is Dai which was initially backed by Ethereal (ETH).

- Crypto-Collateralized

-

- Non-Collateralized

- These are not backed by anything and may seem scary. However, if you look at US dollar today, which isn’t backed by anything and used to be backed by gold decades ago. These cryptocurrencies are driven by the algorithms, that adjust based on the demand and allow the coin to be minted/generated. One example is Ampleforth (AMPL) that adjusts its algorithms to supply the coins based on the daily demand.

- Non-Collateralized

The benefits are stablecoins include:

-

- Potential for day to day currency like fiat currency

- smart contracts allow for better managing the payment workflows

- Fast and affordable money transfers across borders for migrant workers

- Protection against fiat currency devaluation and market volatility

- Facilitating Decentralized Forex (DeFo)

There are some limitations which include:

-

- Recent scandal with Tether really clouded the way the stablecoin issuers were operating behind the scenes but regulation should mitigate this concern

- To enable trust, an independent third part audit is mandatory

- Fiat backed stablecoins are again tied up with the regulation on the fiat side

- Crypto pegged stablecoins have their own issues due to volatility

Central Bank Digital Currencies (CBDCs):

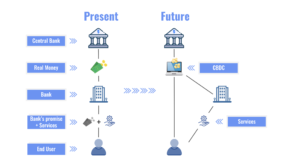

Central Bank Digital Currencies, CBDCs as they are called are nothing but the digital token or electronic record of a country’s official currency. They are not stablecoins but can fill a similar role. The difference is that the CBDCs are issued and controlled by the Central Bank of the country. They could be exchanged one for one with their equivalent fiat and likely to be considered legal tender. This can reduce the cost of managing cash (yes it requires raw material, metals to print money) and promote financial inclusion to the underserved communities that don’t have access to any financial institutions in their location. Nigeria has a working CBDC called eNaira while China (digital yuan, called e-CNY) and other countries are running trials to vet it out.

The following diagram illustrates the future of CBDCs.

Source: Digital Asset

There are many benefits in this flow including better identification of money laundering, inclusion of underserved communities and potential for innovative payment systems and financial services.

This concludes the review of stablecoins and CBDCs. We will pick up the creator economy and NFS next time.

![Crypto Statistics [year]: Global Ownership & Adoption Data 1 Global Cryptocurrency](https://thesmallbusinessblog.net/wp-content/uploads/2022/03/Global-Cryptocurrency.png) Courtesy: Small business blog

Courtesy: Small business blog![Crypto Statistics [year]: Global Ownership & Adoption Data 2 cryptocurrency](https://thesmallbusinessblog.net/wp-content/uploads/2022/03/cryptocurrency.png)

:strip_icc()/2008-financial-crisis-3305679-final-JS-03a006d464d7465aaf331145a1252beb.png)